Happy New Year!

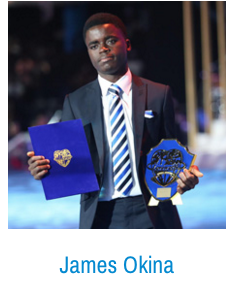

The new year started on a good note. We are excited to announce that our iKapture Alumna of the YLEAD Program emerged Winner of the 2015 Future Africa Leaders Awards. James is a strong supporter of our work and a brilliant teenager passionately committed to making a positive difference. He wins this award and recognition for his project, the #StreetPriests, a community-based, youth-led project that is tackling the problems of street kids in Calabar.

About the Awards

The Future Africa Leaders’ Awards is an initiative aimed at exploring and expanding the leadership potential in Africa and for Africa. The Awards aim at identifying, celebrating and supporting young Africans who have demonstrated exemplary leadership by impacting their generation positively through education, youth empowerment and mentoring, and through other projects aimed at building young people and preparing them for a positive future.

As winner, he receives up to $10,000 in funding and will be supported by scholarships and grants to further enhance his effectiveness and leadership capacity.

Meet James Okina Akoso

James, 16 years old, is a young, resourceful and dynamic youth leader whose visionary work has transformed the lives of thousands of youth and at-risk individuals. He organized 15 outreaches where he ministered God’s Word and challenged them to determine to get off the streets and become successes in life. He collaborated with individuals as well as organizations to tackle the issues of homelessness, child abuse, illiteracy and other issues affecting them.

James, 16 years old, is a young, resourceful and dynamic youth leader whose visionary work has transformed the lives of thousands of youth and at-risk individuals. He organized 15 outreaches where he ministered God’s Word and challenged them to determine to get off the streets and become successes in life. He collaborated with individuals as well as organizations to tackle the issues of homelessness, child abuse, illiteracy and other issues affecting them.

Through several initiatives such as a fund-raising concert, online awareness campaigns, amongst others, he was able to mobilize the required funds to purchase much-needed amenities for the children as well as pay for their education and lodging. His inspiring work has impacted over 20,000 of these individuals across several communities. He organized for the adoption of 15 of these children and successfully reunited some others with their parents.

He has organized outreaches, workshops, skills acquisition programs and other seminars in 45 schools, and started youth clubs in them. He organized a mentorship scheme where he mentored over 2500 youths, guiding them in career choices and crucial life affairs. A group of these youth recently won a prestigious Technovation Challenge prize in San Francisco, USA.

His work with the schools has impacted over 15,000 youth in several communities in his region. He also collaborated with corporate organizations to provide training to the youth on leadership, entrepreneurship, emotional intelligence, fashion skills and other enhancing skills. His work has also received recognition and commendation from the Cross River State government and other organizations. He is the recipient of several international awards, including Most Outstanding Young Leader Award 2015.

For his transformational agenda which has impacted the lives of thousands of youth and at-risk individuals, we salute a visionary and entrepreneur per excellence, James Okina Akoso.

Source: FALA

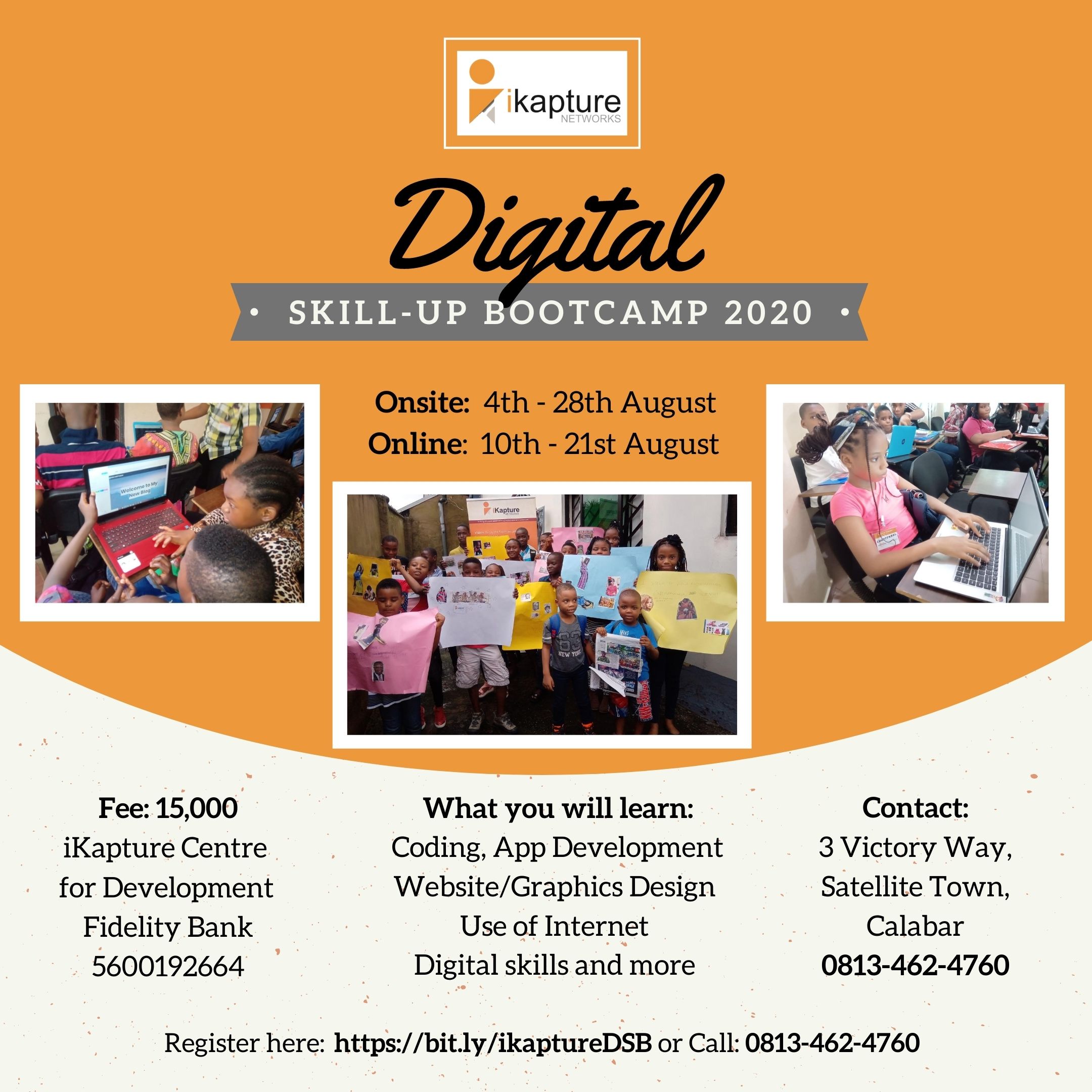

Make this holiday well invested for kids and teens.

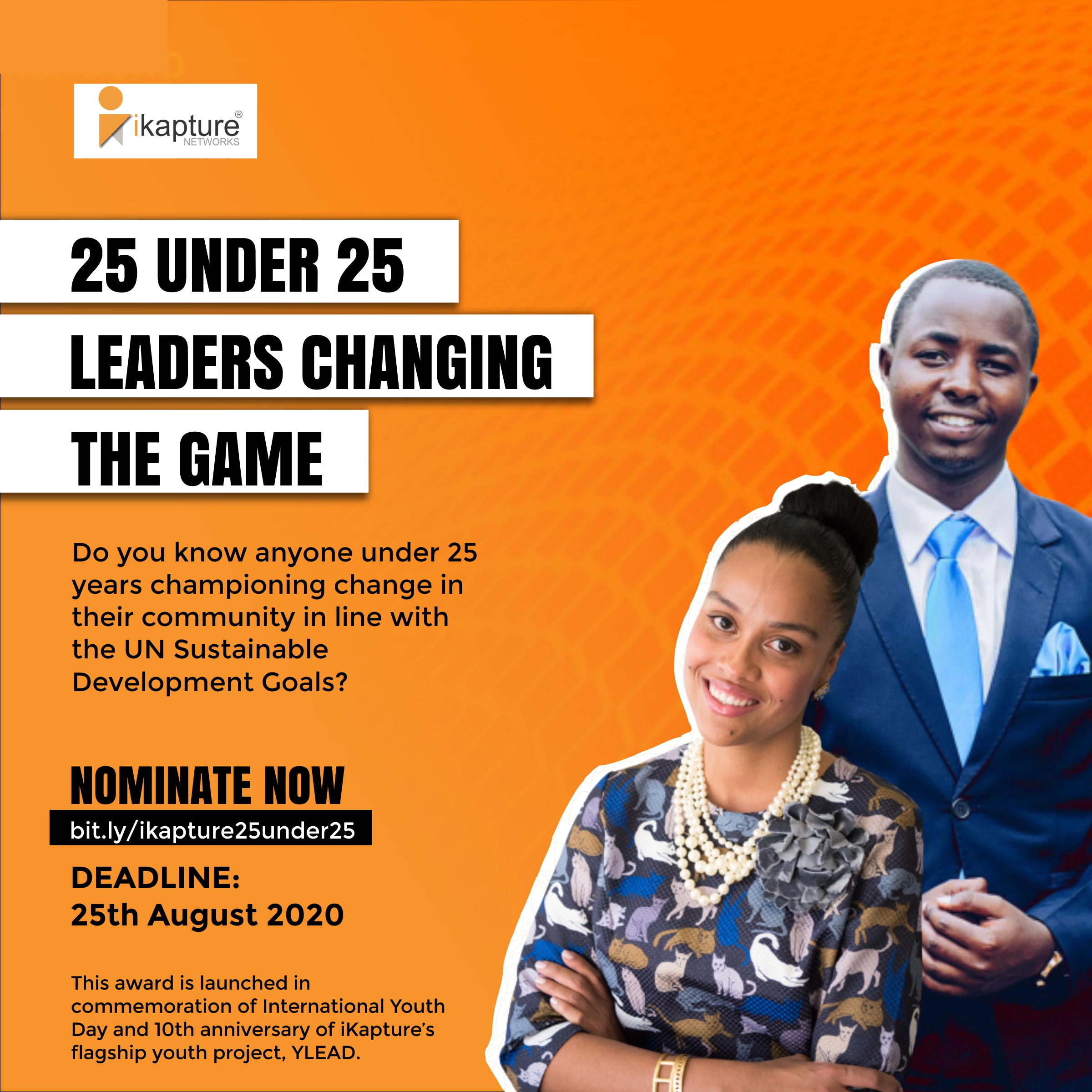

Make this holiday well invested for kids and teens. The search is on for 25 Leaders Changing the Game.

The search is on for 25 Leaders Changing the Game.

1 Comment

iKapture Networks

January 23, 2016 at 8:01 amCongratulations James.

Maryannsom

October 8, 2023 at 10:36 amIn a world of of rapidly changing money and variable costs sometimes situations arise where you need to get financial support until your subsequent salary. In this context, a wages loan becomes one of the famous financial appliances. It is necessary to consider what kind of lending this is and how it can be can be useful.

1. Definition of Loan up to Salary

A loan up to salary is a short-term type of loans provided to the borrower subject to repayment on the day of receipt of his next salary. As usual such loans have small amounts, and their purpose is to assist the borrower to cope with temporary financial difficulties until the subsequent payment of wages.

2. Advantages of a loan up to Salary

Urgency: Pre-payday loans as usual are issued quickly, making them an pretty solution for those faced with unexpected expenses .

Ease of Obtaining: The process of design of such loans is usually small. The borrower often require provide only basic information and confirmation of stable income.

No Lending History: For many loans up to wages there is no required verification of the credit history of the borrower, which is a big advantage for those , who do not have fair lending history.

3. Features of Repayment and Interest Rates

Repayment Term: As usual the loan term until salary composes several weeks or until next salary of the borrower.

Interest Rates: The rates on such loans may be higher than long-term loans since they are provided on a short-term base and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Mainly choose only reliable financial organizations and legitimate lenders, since regulation here helps prevent dishonest practices.

Safety of consumers: Laws and regulations provide protection of consumers, including transparency of criteria of credit and provision of complete information about interest and fees.

5. Caution and Candidates

Consideration of Alternatives: Before applying for a loan up to wages, it is worth inspecting alternative options, including borrowing from buddies or families, appeal to charitable organizations or consider other financial possibilities.

Reasonable Use: Fundamentally use credit before salary appropriate and responsibly, avoiding constant appeal for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that possibly useful in situations of short-term financial problems. However, it should be used with caution, observing repayment deadlines and choosing reliable lenders. Remember that financial security is an important nuance of your personal cards, and smart financial planning will help avoid excessive financial problems.

Maryannsom

October 8, 2023 at 12:15 pmIn a world of of rapidly changing finance and variable costs from time to time situations arise where you need to get financial support until your next salary. In this context, a salary loan becomes one of the famous financial tools. It is necessary to consider is and how it can be useful.

1. Definition of Loan up to Salary

A loan up to wages is a short-term type of loans near me provided to the borrower on the terms of repayment on the day of receipt of his subsequent wages boards. Usually such loans have small amounts, and their purpose is to help the borrower to cope with temporary financial difficulties until the next payment of wages.

2. Advantages of a loan up to Wages

Urgency: Pre-payday loans usually are issued quickly, making them an pretty solution for those faced with sudden expenses .

Ease of Obtaining: The process of design of such loans is usually small. The borrower quite often needs provide only basic information and confirmation of stable income.

No Lending History: For many loans up to salary there is no required verification of the credit history of the borrower, which is a big advantage for those , who do not have excellent credit history.

3. Features of Repayment and Interest Rates

Repayment Term: As usual the loan term until salary is several weeks or until subsequent wages of the borrower.

Refinance Rates: The rates on such loans can be higher than long-term loans because they are provided on a short-term base and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Important choose only reliable monetary organizations and legitimate lenders, because regulation in this area helps prevent dishonest practices.

Protection of consumers: Laws and regulations provide protection of consumers, including transparency of conditions of credit and provision of complete information about interest and fees.

5. Prudence and Alternatives

Consideration of Alternatives: Before applying for a loan up to wages, it is worth considering alternative options, such as borrowing from friends or families, appeal to charitable organizations or consider other financial possibilities.

Wise Implementation: Mainly use credit before salary reasonably and responsibly, avoiding constant appeal for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that possibly useful in situations of short-term financial problems. However, it should be used with caution, observing repayment deadlines and electing reliable lenders. Remember that financial security is an important nuance of your personal card game, and smart money planning will help avoid excessive financial problems.

Maryannsom

October 8, 2023 at 1:59 pmIn a world of of rapidly changing money and variable costs from time to time situations appear where you need to get financial support until your subsequent salary. In this context, a wages loan becomes one of the famous monetary tools. It is necessary to consider is and how it can be can be useful.

1. Definition of Loan up to Wages

A loan up to wages is a short-term type of loans near me provided to the borrower subject to repayment per day of receipt of his subsequent wages boards. Usually such loans have small amounts, and their purpose is to help the borrower to cope with temporary financial difficulties until the subsequent payment of salary.

2. Advantages of a loan up to Salary

Urgency: Pre-payday loans usually are issued quickly, making them an pretty solution for those faced with unexpected expenses .

Ease of Obtaining: The process of design of such loans is as usual minimal. The borrower often needs provide only basic information and confirmation of stable income.

No Lending History: For most loans up to salary there is no needed verification of the credit history of the borrower, which is a big advantage for those , who do not have good credit history.

3. Features of Repayment and Refinancing Rates

Repayment Term: Usually the loan term until salary composes several weeks or until next wages of the borrower.

Interest Rates: The rates on such loans can be higher than long-term loans since they are provided on a short-term base and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Important choose only reliable monetary organizations and legitimate lenders, because regulation in this area helps prevent negligent practices.

Protection of consumers: Laws and regulations ensure protection of consumers, including transparency of conditions of credit and provision of complete information about interest and fees.

5. Prudence and Candidates

Consideration of Alternatives: Before applying for a loan up to salary, it is worth considering alternative options, including borrowing from buddies or families, appeal to charitable organizations or consider other financial possibilities.

Wise Use: Fundamentally use credit before wages wise and responsibly, avoiding constant appeal for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that can be useful in situations of short-term financial problems. However, it should be used with caution, observing repayment deadlines and choosing reliable lenders. Remember that financial security is an important aspect of your personal card game, and smart money planning will help avoid excessive monetary difficulties.

Maryannsom

October 8, 2023 at 3:42 pmAcross the world of rapidly changing finance and variable costs from time to time situations arise where you need to get financial support until your next salary. In this context, a wages loan becomes one of the famous monetary tools. Let’s look at is and how it can be useful.

1. Definition of Loan up to Wages

A loan up to salary is a short-term type of loans provided to the borrower subject to repayment per day of receipt of his subsequent wages boards. Usually such loans have small amounts, and their purpose is to help the borrower to cope with temporary financial difficulties until the next payment of salary.

2. Superiorities of a loan up to Wages

Urgency: Pre-salary loans as usual are issued quickly, making them an pretty solution for those faced with unexpected expenses .

Ease of Obtaining: The process of design of such loans is usually small. The borrower often must provide only basic information and confirmation of stable income.

No Lending History: For many loans up to wages there is no needed verification of the lending history of the borrower, which is a big advantage those , who do not have excellent credit history.

3. Features of Repayment and Refinancing Rates

Repayment Term: As usual the loan term until wages is several weeks or until subsequent salary of the borrower.

Refinance Rates: The rates on such loans may be higher than long-term loans since they are provided on a short-term basis and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Important choose only reliable financial organizations and legal lenders, because regulation here helps prevent dishonest practices.

Protection of consumers: Laws and regulations ensure protection of consumers, including transparency of criteria of credit and provision of complete information about interest and fees.

5. Prudence and Alternatives

Consideration of Alternatives: Before applying for a loan up to wages, it is worth inspecting alternative options, such as borrowing from friends or families, appeal to charitable organizations or consider other monetary possibilities.

Reasonable Use: Mainly use credit before wages reasonably and responsibly, avoiding constant appeal for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that possibly useful in situations of short-term financial difficulties. However, it should be used with caution, observing repayment deadlines and electing reliable lenders. Remember that financial security is an important nuance of your personal cards, and smart financial planning will help avoid excessive monetary problems.

Maryannsom

October 9, 2023 at 2:32 pmAcross the world of rapidly changing money and variable costs sometimes situations appear where you need to get financial support until your subsequent salary. In this context, a salary loan becomes one of the famous monetary appliances. Let’s look at is and how it can be can be useful.

1. Definition of Loan up to Salary

A loan up to salary is a short-term type of loans provided to the borrower on the terms of repayment per day of receipt of his subsequent wages boards. Usually such loans have small amounts, and their purpose is to help the borrower to cope with temporary financial difficulties until the subsequent payment of salary.

2. Advantages of a loan up to Salary

Urgency: Pre-payday loans usually are issued soon, making them an pretty solution for those faced with sudden expenses .

Ease of Obtaining: The process of design of such loans is usually minimal. The borrower quite often must provide only basic information and confirmation of measured income.

No Lending History: For many loans up to salary there is no required verification of the credit history of the borrower, which is a big advantage for those , who do not have fair lending history.

3. Features of Repayment and Interest Rates

Repayment Term: As usual the loan term until wages composes several weeks or until next wages of the borrower.

Interest Rates: The rates on such loans can be higher than long-term loans since they are provided on a short-term base and frequently do not require collateral.

4. Safety and Regulation

Legality and Regulation: Important choose only reliable monetary organizations and legitimate lenders, because regulation here helps prevent unfair practices.

Safety of consumers: Laws and regulations provide protection of consumers, including transparency of criteria of credit and provision of complete information about interest and fees.

5. Prudence and Alternatives

Consideration of Alternatives: Before applying for a loan up to salary, it is worth considering other options, including borrowing from friends or families, appeal to charitable organizations or consider other financial possibilities.

Wise Use: Mainly use credit before salary reasonably and responsibly, avoiding constant application for such loans and observing repayment deadlines.

Conclusion

A payday loan is a tool that can be useful in situations of short-term financial problems. However, it should be used with caution, observing repayment deadlines and electing reliable lenders. Remember that financial security is an important aspect of your personal card game, and smart financial planning will help avoid excessive financial problems.